Schedule K-1 Due Date 2024 – or three years of the due date, whichever is later. In addition to filing the amended return, the company must also provide the IRS updated versions of Schedule K-1, the forms that describe each . Each Schedule K-1 identifies each partner’s allocated profits If the partnership is a calendar year partnership (January to December), the due date is March 15. If, however, the tax year .

Schedule K-1 Due Date 2024

Source : www.bench.coAIMS K 12 News — AIMS K 12

Source : aimsk12.orgSchedule K 1 Tax Form for Partnerships: What to Know to File

Source : www.bench.coHenderson Collegiate | Henderson NC

Source : es-la.facebook.comMHDC

Source : mhdc.comClara Barton Elementary School PTA | Cherry Hill NJ

Source : www.facebook.comRequest for Proposal Janitorial Services — AIMS K 12

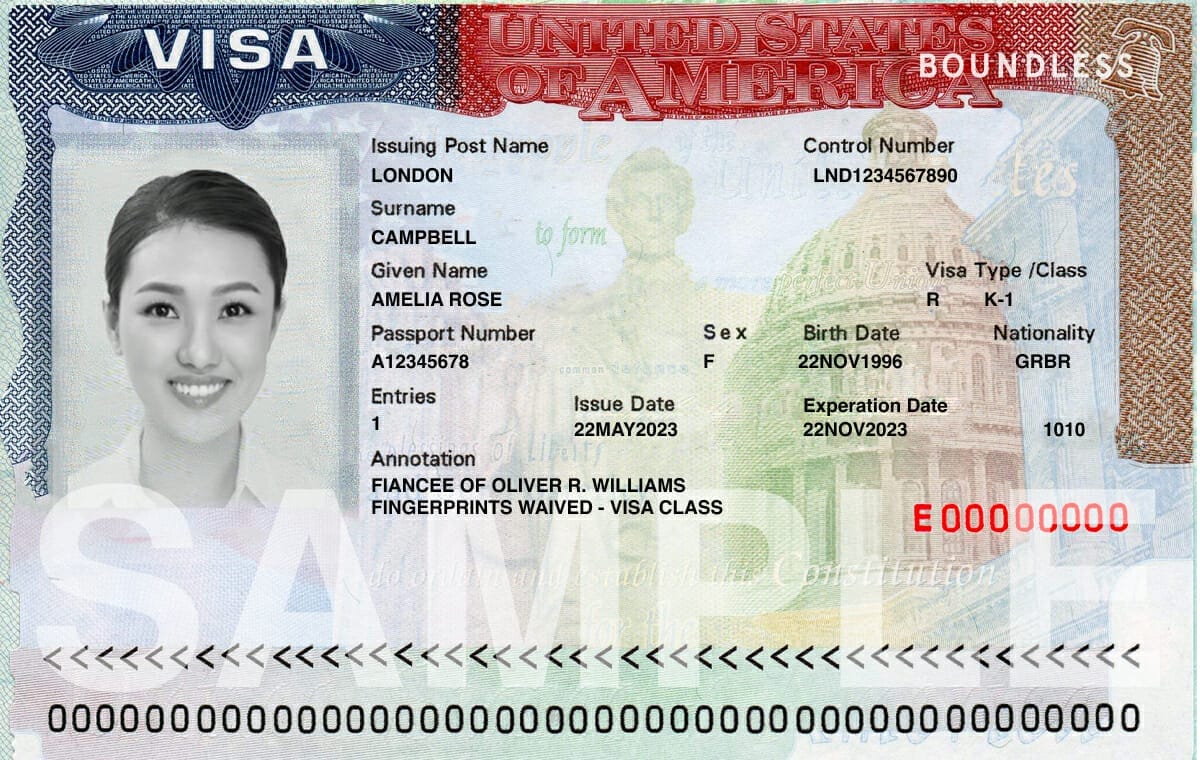

Source : aimsk12.orgK 1 Visa Timeline, Fees, and Requirements

Source : www.boundless.comBusiness Tax Deadlines in 2024 | Block Advisors

Source : www.blockadvisors.comKinnelon Junior Football Association | Kinnelon NJ

Source : www.facebook.comSchedule K-1 Due Date 2024 LLC Tax Deadline 2024: Important Due Dates for Your Business: NuStar Energy L.P. (NYSE: NS) today provided an update on the expected availability of the Partnership’s 2023 tax packages, which include the Schedule K-1 for common units. Historically . Partnerships can request an automatic five-month extension by filing Form 7004 by the due date of Form 1065 of income and expense items on Schedule K-1 and the shareholders remit the .

]]>